reit tax benefits uk

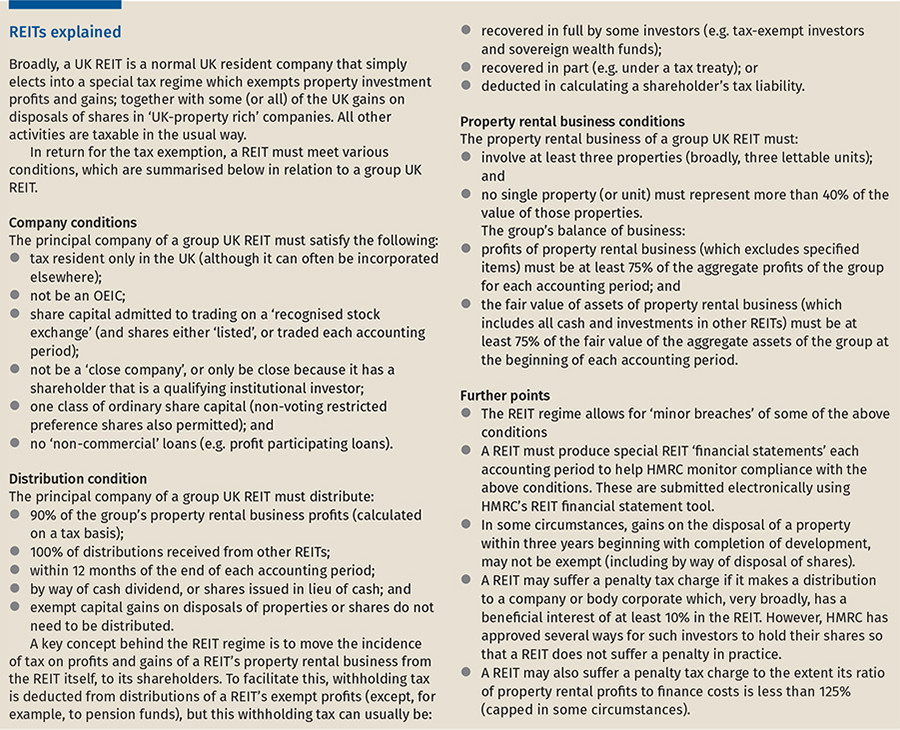

Taxation of a UK REIT A UK REIT needs to carry on a property rental business and meet the various conditions for REIT status. When market conditions improve the regime is expected to have a positive long-term impact on the UK listed real estate sector and it is hoped that the proposed benefits of the UK REIT regime will be fully realised.

Section 162 Executive Bonus Plan And It S Benefits How To Plan Life Insurance Policy Permanent Life Insurance

Thanks to the 2017 Tax Cuts and Jobs Act sweeping new changes to the tax code allow for a lucrative tax benefit for REIT investors.

. 5 rows Advantage 3 - Tax Efficiencies. A Real Estate Investment Trust REIT is exempt from UK tax on the income and gains of its property rental business. REIT Tax Benefits No.

This relaxation will provide a further vehicle for joint ventures with the benefit of liquidity and the additional flexibility of enabling co-investors to exit at different. Wachovia Hybrid and Preferred Securities WHPPSM Indicies. The UK REIT regime is an improvement to the tax environment for UK real estate companies.

An advantage of the regime is that qualified property rental businesses subject to the REIT tax benefit are not subject to UK corporation tax. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. The pass-through deduction allows REIT investors to deduct up to 20 of their dividends.

As long as the business does not engage in activities that interfere with its other activities its other activities fall under corporation tax. These property-owning companies receive tax benefits in return for paying out most of their income as dividends. How Is Reit Income Taxed Uk.

A Real Estate Investment Trust REIT is exempt from UK tax on the income and gains of its property rental business. While REITs are tax-efficient for investors using ISAs or SIPPs investments in REITs outside of these accounts could incur large tax bills. A REIT is exempt from corporation tax on both rental income and gains on sales of investment properties and shares in property investment companies used in a property rental business carried on in the UK.

Distributions from the PRB in the hands of investors are taxed as a PID and distributions from the residual business are taxed as ordinary dividends in the normal way. In return UK REITs are required to distribute at least 90 of their taxable income for each accounting period to investors where the income is treated as property rental income. This occurs when a REIT sells a property that it has owned for over a year and chose to distribute that income to shareholders.

A potentially high tax bill. A high distribution requirement also protects the UK tax base because the point of taxation for a UK REIT is in the hands of investors where distributions may be subject to withholding tax at 20. Long-term capital gains are.

Property rental business Property rental business profits and gains are tax-exempt within the REIT itself. REITs dont pay corporation or capital gains tax. Your REIT Income Only Gets Taxed Once When a typical corporation makes money it has to pay taxes on its profits.

Depreciation and Return of Capital. In the UK a company or group of companies can apply for UK REIT status which provides exemption from corporation tax on profits and gains from their UK-qualified property rental businesses. Preferred shares in addition to five.

UK REITs hold a number of benefits for prospective investors not least of which is a generous tax break. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. A REIT investor REIT can now invest in another REIT target REIT without a tax penalty so long as the investor REIT distributes to its shareholders the whole of the rental distribution received from the target REIT.

The tax is instead transferred to the shareholders which means broadly that the investors are put in the same tax position as if they had invested directly in the underlying. Real Estate Investment Trusts REITs were introduced in the UK in 2007. If it pays a dividend to shareholders thats after-tax.

In return UK REITs are required to distribute at least 90 of their taxable income for each accounting period to investors where the income is treated as property rental income. This is particularly true for those who pay higher- or additional-rate Income Tax reducing profits by as much as 40 or 45 respectively. These three REITs have an average dividend yield of 67.

The income from a REIT investing in another UK REIT is treated as income of the investing REITs tax exempt property rental business provided the investing REIT distributes to its investors 100 of the property income distribution it receives from investing in another REIT. REITs benefit from some pretty special tax advantages. In the UK a company or group of companies can apply for UK REIT status which provides exemption from corporation tax on profits and gains from their UK-qualified property rental businesses.

A UK-REIT is either a company or group that carries on. Tax charges can arise if any of the conditions for qualifying for REIT status are breached although. Furthermore a REIT is able to benefit from a rebasing of underlying property assets when it acquires a company owning property investments meaning that the target.

We dont support this browser anymore. Part 12 of the Corporation Tax Act 2010 provides for a special tax regime for Real Estate Investment Trusts UK-REITs. The point of a REIT is that it can enjoy exemption from corporation tax on its property rental business and also on any gains from disposals of properties that form part of that property business.

More freedom is provided by the ability to invest in commercial property through such REITs which can yield much greater profits than residential property investing alone and the fact that UK REITs are highly liquid meaning you are not. This allows it to benefit from exemptions from UK corporation tax on profits and gains arising from its property rental business.

Taxation Of Reits Ringing In The Changes

How Income Tax Rules Help Reit Investors Earn More In Long Term Mint

Difference Between Epf And Ppf Income Investing Investing Basic

Real Estate Investment Trusts Tax Adviser

Real Estate Investment Trusts How To Build Your Own Reit Portfolio Real Estate Investment Trust Real Estate Investing Real Estate Investing Books

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

What Are The Best Reits To Invest In United Kingdom Investing Strategy Safe Investments Marketing Jobs

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

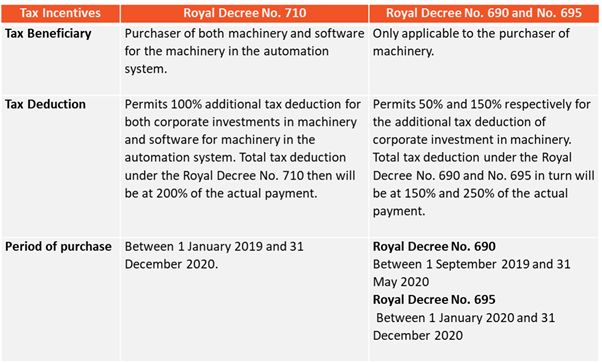

How Europe Promotes Electric Vehicles A Brief Insight On Best Practices Rail Road Cycling Turkey

200 Tax Deduction In Thailand For Investment In Automation System Income Tax Thailand

Conversable Economist What Should Be Included In Income Inequality Income Inequality C Corporation

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

Commercial Real Estate Tax Benefits And How To Take Advantage Of Them Pioneer Realty Capital

Commercial Real Estate Tax Benefits And How To Take Advantage Of Them Pioneer Realty Capital

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen